A World Full of Opportunities

Allocating to International Equities

1Source: eVestment.

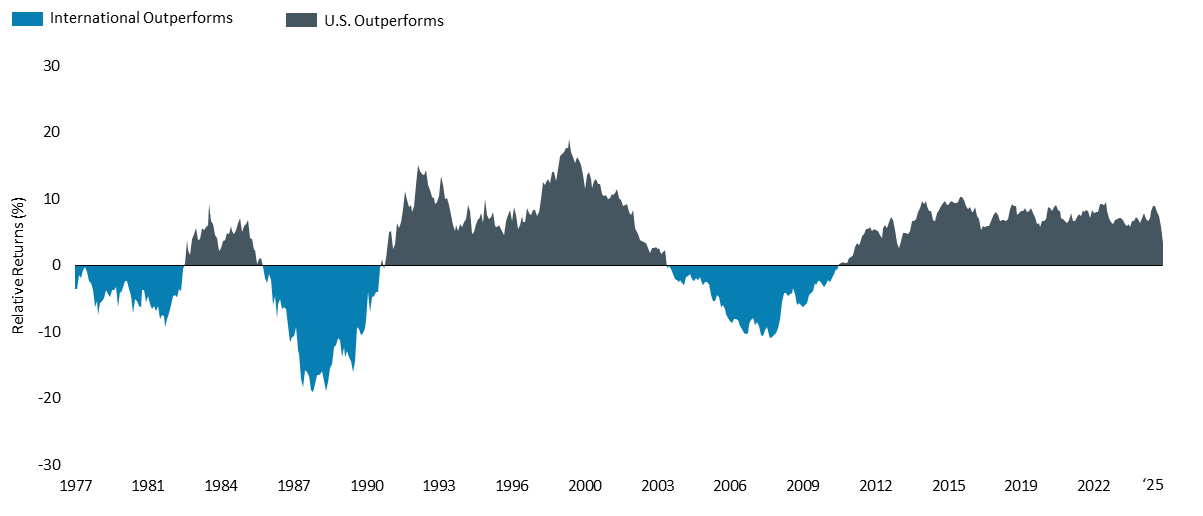

2Sources: Bloomberg and eVestment; monthly 5-year rolling returns. U.S. outperformance represented by S&P 500 Index; International outperformance represented by MSCI World ex-U.S. Index.

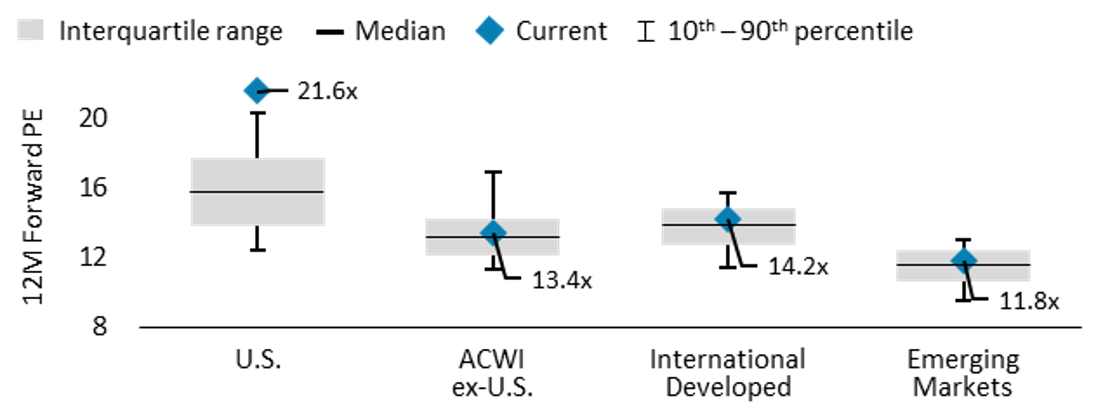

3Source: Bloomberg; U.S. is S&P 500 Index, ACWI ex-U.S. is MSCI ACWI ex-U.S. Index, International Developed is MSCI World ex-U.S. Index and Emerging Markets is MSCI Emerging Markets Index.

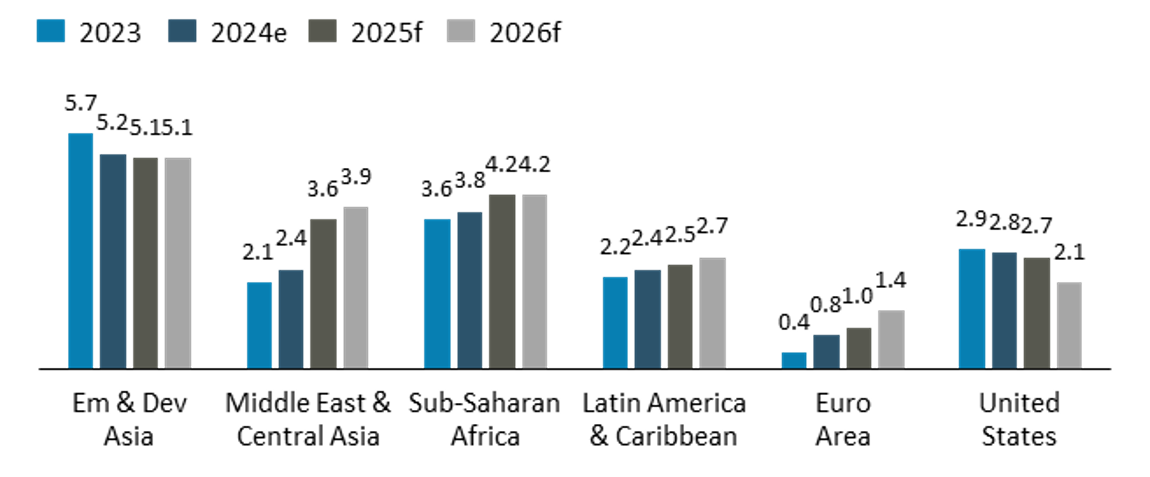

4Source: International Monetary Fund, World Economic Outlook Update, April 2025

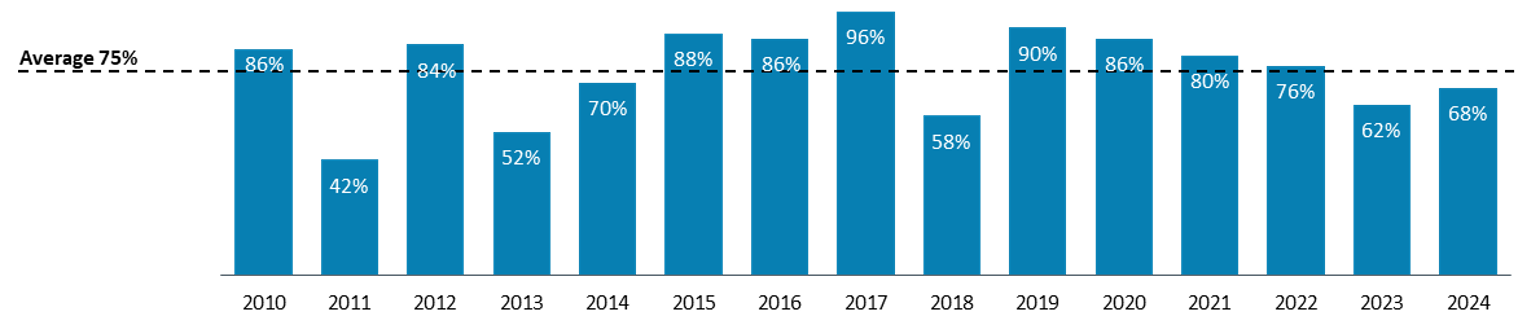

5Sources: FactSet, eVestment. U.S. Dollar value determined by the ICE U.S. Dollar Index - Price. Calendar years outperformance and percentage outperformance (cumulative) calculated using MSCI ACWI ex-U.S. Index versus S&P 500 Index.

6Sources: FactSet, eVestment. Top performing 50 stocks based on companies in the MSCI All Country World Index.

7Source: APX.

Investors should consider the investment objectives, risks, charges and expenses of the fund carefully before investing. This and other information can be found in the prospectus or summary prospectus. A prospectus or summary prospectus may be obtained by visiting bairdfunds.com. Please read the prospectus or summary prospectus carefully before investing.

The Fund may hold fewer securities than other diversified funds, which increases the risk and volatility because each investment has a greater effect on the overall performance. Foreign investments involve additional risks such as currency rate fluctuations and the potential for political and economic instability, and different and sometimes less strict financial reporting standards and regulations.

The S&P 500® Total Return Index is an unmanaged, market capitalization-weighted index of 500 common stocks widely regarded to be representative of the U.S. market in general. Returns include reinvestment of dividends. The MSCI World ex-U.S. Index® is a free float-adjusted market capitalization-weighted index that is designed to capture large- and mid-cap representation across 23 developed market countries excluding the United States. The MSCI ACWI ex-U.S. Index® is a free float-adjusted market capitalization-weighted index that is designed to capture large- and mid-cap stocks across 22 of 23 developed markets countries, excluding the United States, and 24 emerging markets countries. The MSCI Emerging Market Index® is a free float-adjusted market capitalization-weighted index that is designed to capture large- and mid-cap stocks across 24 emerging markets countries. Indices are unmanaged and direct investment is not possible.

The MSCI information may only be used for your internal use, may not be reproduced or disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties or originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

©2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Baird Funds are offered through Robert W. Baird & Co., a registered broker/dealer, member NYSE and SIPC. Robert W. Baird & Co. also serves as investment advisor for the Fund and receives compensation for these services as disclosed in the current prospectus. ©2024 Robert W. Baird & Co. Incorporated. First use: 06/2024

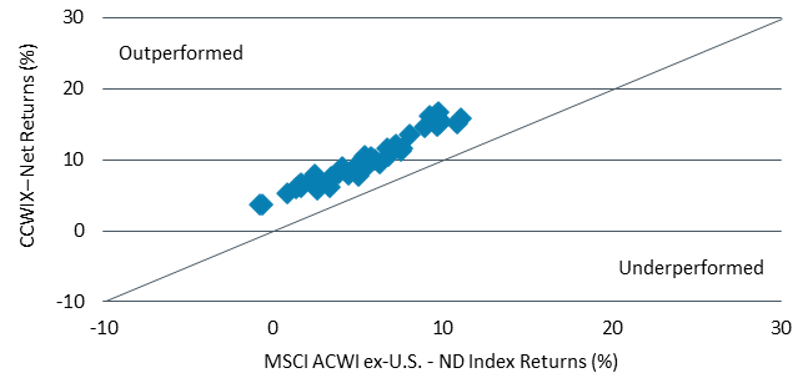

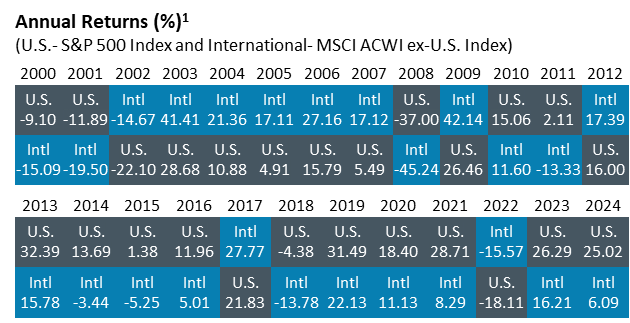

Reviewing annual returns since 2000 or five-year rolling returns since the 1970s highlights the fact that cycles of U.S. and international leadership tend to be long and varied. Prior to the most recent U.S. dominance, there was a long period of international outperformance in the 2000s and several years in the 1980s and 1970s. With the relative underperformance of international equities again approaching historical extremes in both duration and magnitude, experience indicates that international stocks are due to reclaim market leadership.

Reviewing annual returns since 2000 or five-year rolling returns since the 1970s highlights the fact that cycles of U.S. and international leadership tend to be long and varied. Prior to the most recent U.S. dominance, there was a long period of international outperformance in the 2000s and several years in the 1980s and 1970s. With the relative underperformance of international equities again approaching historical extremes in both duration and magnitude, experience indicates that international stocks are due to reclaim market leadership.